in HOW TO

How to Invest in Stocks and Make a Profit in Nigeria

by

Infoview Editorial

1.3k Views

Infoview Editorial

1.3k Views

- Educate Yourself:

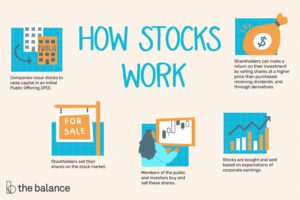

- Learn the basics of stock market investing, including how it functions, key terminology, and different types of stocks.

- Understand financial statements, such as balance sheets, income statements, and cash flow statements.

- Read books, attend seminars, and follow reputable financial websites and blogs to stay updated on market trends and investment strategies.

- Set Financial Goals and Risk Tolerance:

- Define your investment objectives, whether it’s long-term wealth accumulation, retirement planning, or specific financial goals.

- Assess your risk tolerance by considering factors such as your age, financial stability, and investment timeframe.

- Open a Brokerage Account:

- Research and select a reputable brokerage firm in Nigeria that provides online trading services.

- Complete the account opening process, including providing necessary identification and financial information.

- Ensure the brokerage firm is registered with the Nigerian Stock Exchange (NSE) and regulated by the Securities and Exchange Commission (SEC).

- Conduct Thorough Research:

- Analyze individual companies listed on the Nigerian Stock Exchange to identify potential investment opportunities.

- Evaluate their financial health, business models, competitive advantages, and growth prospects.

- Use financial news sources, company reports, and analyst recommendations to gather relevant information.

- Develop an Investment Strategy:

- Determine your investment approach, whether it’s long-term investing, value investing, or trading.

- Set criteria for selecting stocks, such as industry sectors, market capitalization, or dividend yield.

- Consider diversification by investing in a mix of different stocks to spread risk.

- Monitor the Market:

- Stay updated on market trends, economic news, and company announcements that may impact stock prices.

- Regularly review the performance of your stock holdings and make informed decisions based on new information.

- Utilize stock market analysis tools and resources to track stock prices, trading volumes, and historical data.

- Execute Trades:

- Place buy or sell orders through your brokerage account’s online trading platform.

- Specify the number of shares and the desired price at which you want to execute the trade.

- Consider setting stop-loss orders to limit potential losses and protect your investment.

- Practice Risk Management:

- Only invest funds that you can afford to lose and avoid overexposing yourself to a single stock or sector.

- Set realistic expectations and be prepared for market fluctuations and volatility.

- Regularly review and rebalance your portfolio to maintain an appropriate asset allocation.

Leave a Reply